2024 economic picture beginning to take shape

At the beginning of the year, we laid out four major questions for 2024: Will inflation continue to fall toward the target of 2%? Will the Federal Reserve cut rates in 2024, and if so, by how much? Will housing become more affordable and available? And finally, will equity markets continue to be dominated by a few names, or will new stocks or sectors lead the way?

While there is still plenty of the year in front of us, we already have some clarity around the answers to these questions as we move through the second quarter.

Can inflation make its final push to 2%?

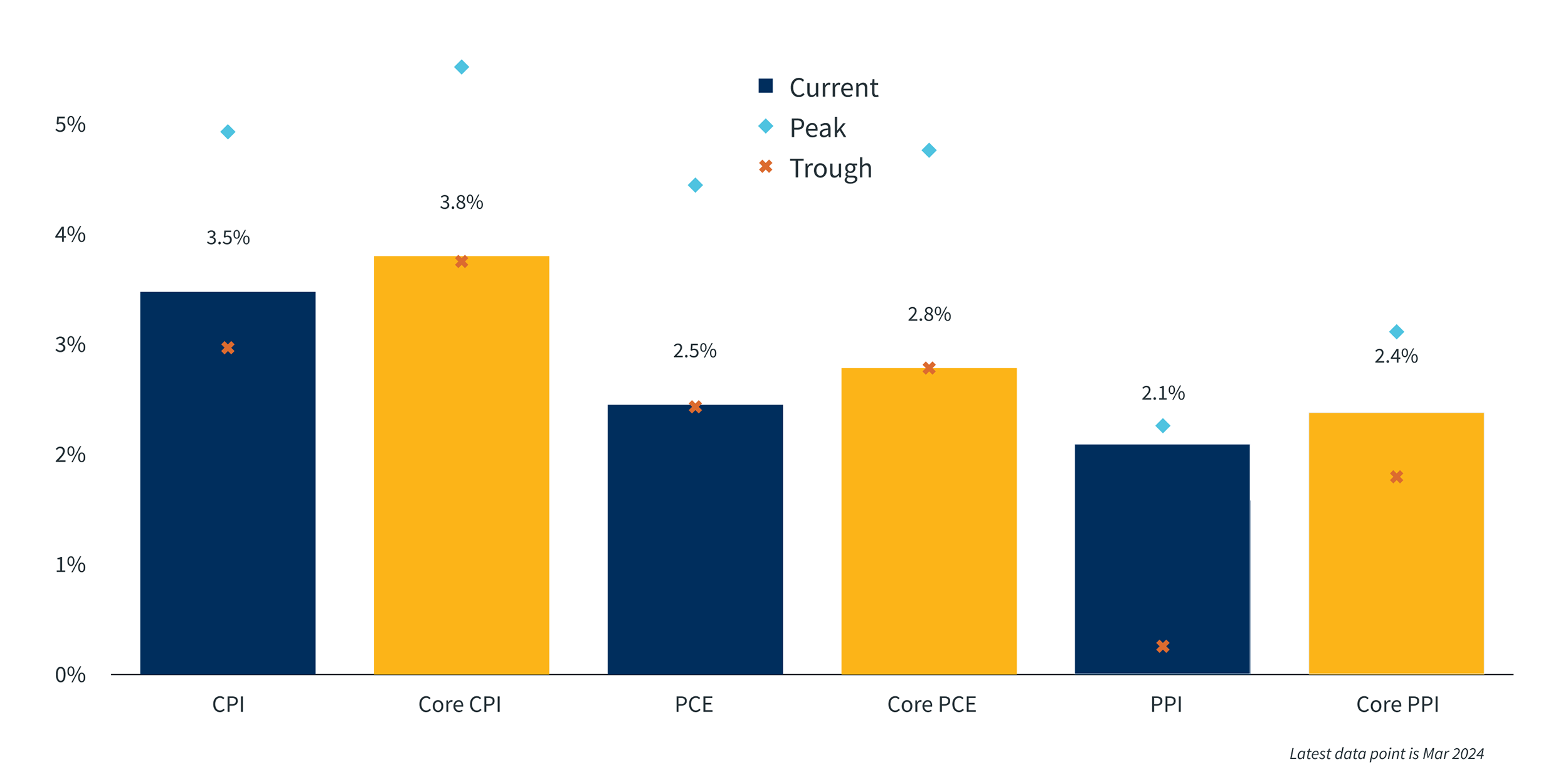

Thankfully, inflation has not drifted higher, but its descent has slowed and by some measures stalled. Since late last year, the headline consumer price index (CPI) has bounced around between 3.1% and 3.5% for six straight months, and is currently sitting at the high end of the six-month range. Core CPI, which excludes food and energy, has been between 3.8% and 4.0% over the same time period. The personal consumption expenditures (PCE) index, the Fed’s preferred inflation measure, has been between 2.4% and 2.6% over the past three months, with no clear indication of going lower.

While these measures are much closer to 2% than they were a year ago, the last leg of the journey to 2% may be the toughest and slowest. Much depends on how fast home prices continue to rise, since housing is a large part of most inflation measures, and on wage growth, which particularly affects the service sector and has been running above 4% since 2021.

Another major contributor to recent inflation numbers has been insurance, especially auto insurance, which has been increasing at roughly 20% per year. Auto insurance is typically renewed annually, so once most policies reset to the new higher level, future increases may be much less, which would help bring inflation down.

Inflation Measures1

Housing remains expensive but positive signs emerge

In general, U.S. home prices continued to rise in the first quarter. While there have been some reports showing month-over-month declines in prices of existing home sales, the year-over-year price changes remain high. Coupled with high mortgage rates, housing affordability remains at its worst level in 40 years.

There are some positive trends for homebuyers, however. New home permits, construction and sales have been rising most months, at least for single-family homes. New home prices have also been falling recently, as builders produce more housing that is smaller and more affordable. The number of existing homes for sale has grown for a few months in a row, improving inventory levels, though total inventory continues to be very low relative to the number of active buyers.

If inventories can improve, both through increased new home construction and more willing sellers of existing homes, prices may moderate or fall. As long as wage growth stays strong and unemployment stays low, affordability will slowly improve over time, even if mortgage rates do not fall much. As mentioned above, the shelter component of most inflation measures is large and has been one of the main contributors to inflation remaining above 2%, so even though the Fed does also look at inflation measures that exclude housing, any relief on housing prices and rents will help reduce inflation over time and make it easier for the Fed to cut rates.

Rate cuts could come later in the year

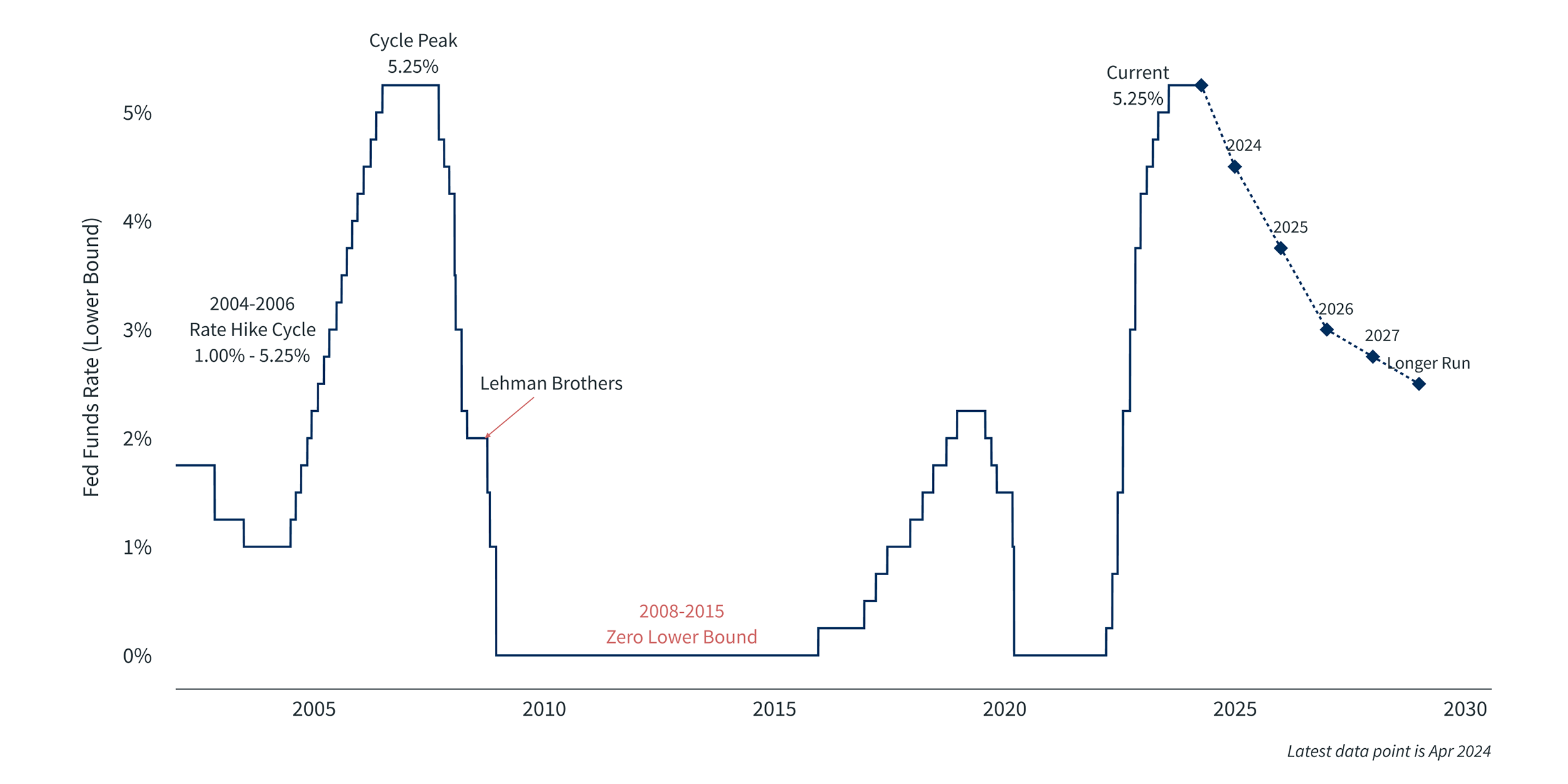

While a lot of progress has been made, inflation readings are still a touch too high, and the Fed has indicated they will not lower rates until the summer at the earliest. The latest dot plot, released in March, still shows an expectation of three cuts in 2024, similar to what the Fed predicted in December. Coming into the year, market observers expected six cuts, but after strong payroll numbers to start the year, fourth quarter 2023 gross domestic product growth that came in above expectations and slightly stronger inflation readings, the market is now more in line with the Fed’s forecast of only three cuts. The reduction in expected rate cuts helped cause the 10-year treasury yield to rise over 0.3% in the quarter, from 3.9% to 4.2%.

Even though inflation has stalled at levels above the Fed’s 2% target, the Fed may still lower rates later this year as real (inflation-adjusted) interest rates are fairly high. In his press conference at the end of the quarter, Fed Chair Jerome Powell said that the recent economic and inflation data did not change the overall economic picture, which “continues to be one of solid growth, a strong but rebalancing labor market, and inflation moving down to 2% on a sometimes-bumpy path.” The Fed is wary of allowing high real interest rates to cause an otherwise avoidable recession, so if it seems like inflation is on a sustainable path to 2%, they will likely cut rates even if the level is still above 2%.

In a sign of progress against inflation around the world, central banks are diverging in their management of short-term rates, as local conditions start to matter more than global issues (such as supply chain issues, geopolitical events, etc.). During the quarter, Switzerland became one of the first major central banks to cut rates since inflation took off in 2021, while most other central banks held their ground on rates but signaled different timing for cuts to begin. Japan, the last remaining major central bank with a negative interest rate, raised their rate in the quarter, taking their short-term rate above zero for the first time since 2016 and ending the era of negative interest rates. At one point in 2020, over $18 trillion in global debt had a negative interest rate, which was more than 20% of all debt issued by governments and companies, but that number is now down to zero.

Federal Funds Rate2

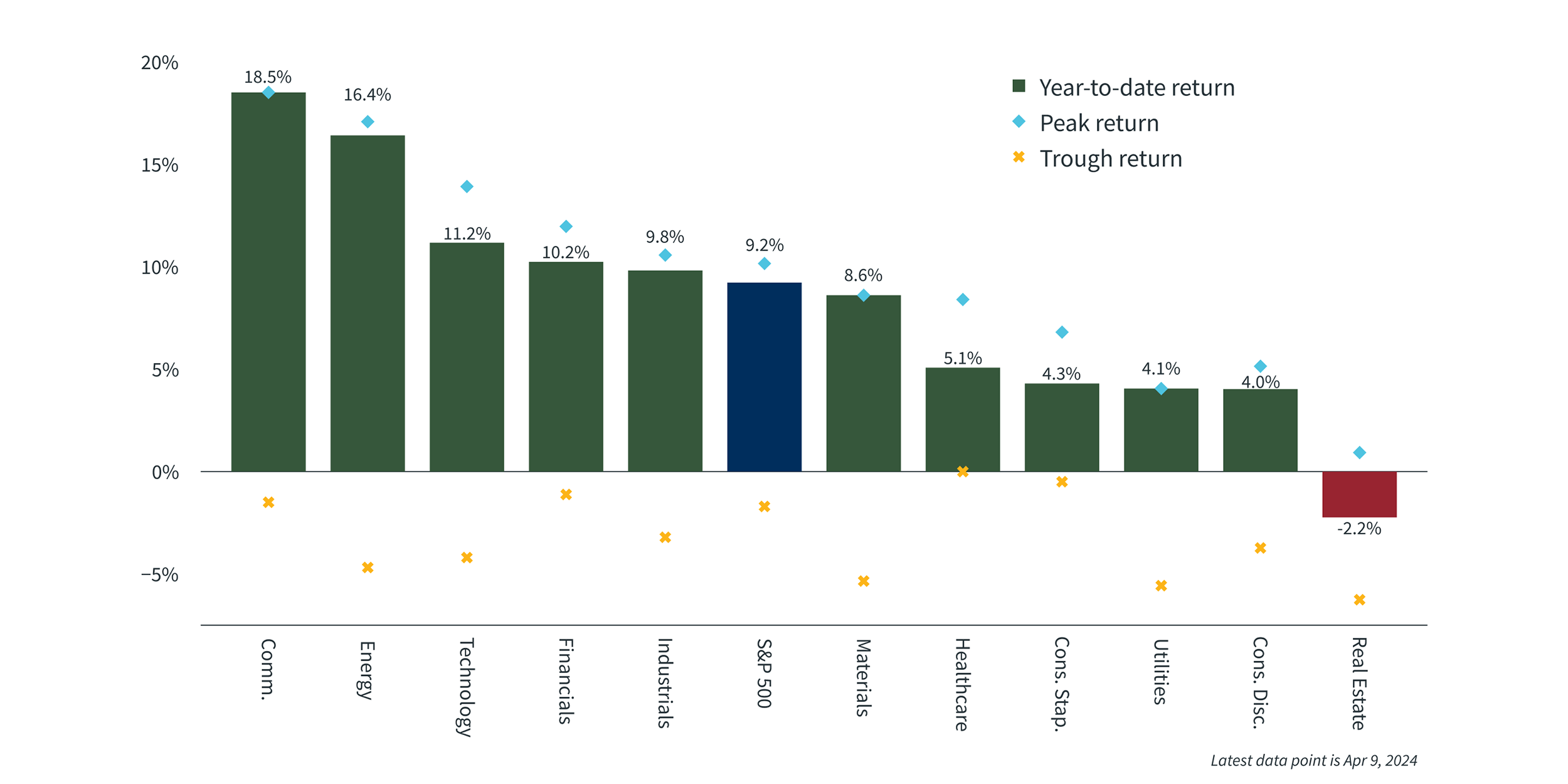

Equity markets look deeper compared to 2023

Turning to equity markets, most U.S. equity indices experienced strong returns in the first quarter. Unlike in 2023, the first quarter of this year experienced much greater breadth in equity market returns. In 2023, only three sectors outperformed the S&P 500 overall, and most of the outperformance in those sectors was due to just a few names, especially the so-called “Magnificent Seven.” These mega-cap names dominated market returns in 2023, but they have diverged from each other in the first three months of 2024. Three of the seven outperformed the S&P 500, while a couple of the stocks – Apple and Tesla – actually fell in value. In addition, this year many sectors and stocks are doing well. Only one sector in the S&P 500 finished down for the quarter, and five sectors outperformed the overall S&P 500. Even small caps, which had been a laggard, were up more than 4% in the first quarter.

In other good news for equity investors, despite the rapid rise in equities over the past five months, valuations are for the most part not getting significantly worse as earnings growth has been strong. On the other hand, with returns up 10% already this year, it will be harder and harder for profit growth to keep up with returns.

Sector Returns – Year-to-Date3

Other things to consider

One of last year’s conundrums was that despite progress on inflation, strong GDP growth and a robust labor market, sentiment about the economy was rather poor. Whether measured by consumer sentiment, consumer confidence, home builder sentiment, small business sentiment or other surveys, most measures of current and future expectations were fairly low in 2023, especially in the context of the positive economic data. That has begun to change, as most measures of sentiment and confidence have been rising over the past few months, which could help keep consumer spending and corporate investment rising.

On the other hand, delinquencies for many types of loans, the level of credit card debt, and concerns about the ability to pay for food and housing have all increased, indicating people have spent most of the excess savings accumulated during the pandemic and are now using debt to maintain their lifestyles, while also cutting back a bit on some unnecessary spending. The delinquency rates are not at very high levels yet, but they are increasing.

A major driver of where spending sentiment and delinquencies head will be the strength of the labor market. As we have seen every month so far in 2024, payroll growth remains very strong, job openings are high relative to the number of unemployed workers, labor force participation is flat or rising, and wage gains are above inflation. This should all help boost sentiment and spending going forward. While the labor market is not as hot as it was a year ago — for example, the number of people quitting their jobs has fallen to pre-pandemic levels, and some companies are cutting contract and temporary workers — it is still creating well over 200,000 new jobs every month without putting significant pressure on inflation.

Investors should continue to focus on long-term goals

It appears the economy remains on track for a soft landing, an outcome where inflation falls to 2% over time, economic growth remains positive and unemployment does not accelerate too much. Over the past year, the economy has withstood major challenges, including high short-term interest rates, geopolitical issues in multiple parts of the world, and disruptions to shipping given challenges in the Panama Canal, Suez Canal and now the bridge collapse in Baltimore, a major East Coast port. Whether the economy can continue to withstand challenges will depend on whether real wages can keep rising, consumer spending and confidence remain positive, and households have savings left to use. It will also depend on whether supply chains can endure the strain being placed on them from wars, drought and accidents.

The outcome for the rest of the year is unknown, but as we saw in 2023, our economy is fairly resilient and markets can do well even in the midst of great uncertainty and in the face of unprecedented challenges. One of the most important ways investors can achieve their investment goals over time is to not let the emotions of euphoria or fear guide their day-to-day investing decisions, but instead focus on long-term goals and risk tolerance.

The views and opinions represented in this message are my own and do not necessarily reflect the perspective of Bremer Bank, its subsidiaries or affiliates, or its employees. This message is provided for information purposes only and nothing in it constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold any security. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor.